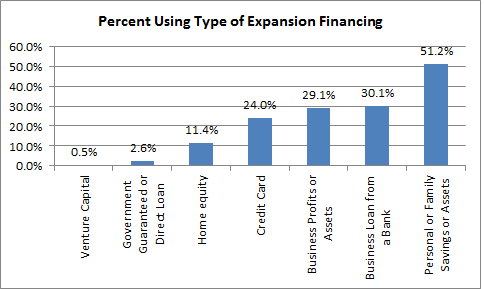

Source: Created from data from the Survey of Business Owners, U.S. Census

Above, I have created a chart that shows the fraction of small businesses with employees in need of expansion financing that obtain different types of capital, using data from the 2007 Survey of Business Owners (SBO), an effort to collect data on:

“. . .more than 2.3 million nonfarm businesses filing 2007 tax forms as individual proprietorships, partnerships, or any type of corporation, and with receipts of $1,000 or more.”

The SBO reveals seven important facts about small business financing:

1. The majority (51.2 percent) of small employers needing money to expand use either their own or family members’ savings or assets.

2. Business profits or assets are a key source of money to expand; 29.1 percent of small employers use this source of expansion financing.

3. Banks are an important source of expansion capital for small businesses; just shy of one-third of small business owners report using a bank loan to finance expansion.

4. Credit cards, both personal and business, are a common source of money for small business expansion, with one quarter of small employers needing expansion funds obtaining at least some of it from this source.

5. More than one-in-ten (11.4 percent) of small business owners report using equity in their homes to finance small business expansion.

6. Government-guaranteed loans and loans from the government, such as SBA loans, aren’t a source of expansion capital for many businesses; the SBO data show that less than 3 percent of small businesses needing expansion capital get money from this source.

7. Almost no small employers use venture capital to expand; the SBO data reveal that only about 0.5 percent use this source of financing.

[“source-ndtv”]