monetary technology participant Paytm Wednesday dominated out becoming a member of the feestruggle inside the savings account hobby charge space whilst it launches its bills bank, as a substitute it will recognition on growing sales-accretive transactions.

“obviously, we do no longer need our clients to lose money if they’re maintaining their money with us,however on the equal time we don’t need to combat a war on hobby costs,” Shinjini Kumar, leaderexecutive-designate of the Paytm’s bills financial institution venture, informed journalists.

Kumar, who simply joined the financial institution from consultancy fundamental p.c, explained that it’s far “counter intuitive” for a bills financial institution to offer higher interest prices because it hasrestrictions on the way it makes use of the deposits.

“it’s miles very counter-intuitive for a payments bank to provide higher fee of interest on financial savings due to the fact they will simply park the cash. i am interested by the money that does things,i’m now not interested in money that sits. money that sits is not proper for me due to the fact i am no longer incomes some thing a lot at the glide,” she said.

it can be referred to that payment banks are required to park 75 percent of their deposits inside the saferbut low yielding fixed income gadgets. they’re also not allowed to use their deposits for lending.

The comments come amid a race within the industrial banks to woo clients with better interest quotes onfinancial savings accounts, thru which they goal to forge sticky relationships that also helps pass–selldifferent financial merchandise.

overseas lender DBS bank currently launched a product imparting 7.1 percent with none ceiling on thequantum, while private quarter lender Kotak Mahindra bank said it will retain with the 6 percentageinterest fee. yes bank also gives comparable hobby quotes on deposits of over Rs. 1 lakh.

Kumar stated the purpose of the impending payments financial institution is to clear up the “friction” in banking through more moderen, progressive strategies and get extra human beings into the banking fold. Kumar stated the chinese online store Alibaba-sponsored company desires to release its billsbank by means of August, inside a 12 months of its founder Vijay Shekhar Sharma being given the in-precept nod with the aid of the Reserve financial institution to enter the fray.

Kumar said there are a couple of things to be taken care of out earlier than it gets the final nod from the RBI, but exuded self assurance that it must no longer witness any troubles.

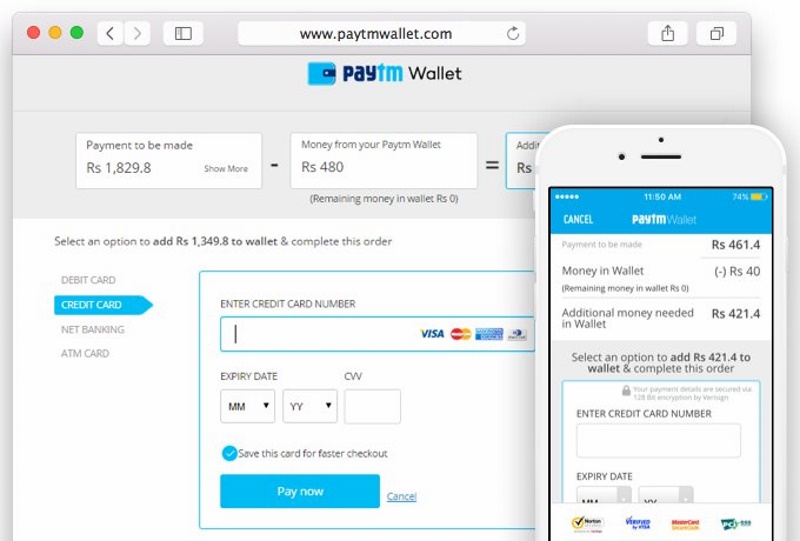

Paytm, which already has one hundred million clients for its pockets, could get all the existing users tocome to be financial institution account holders and is anticipating clarity from RBI on the problem, shestated, adding that issues surrounding KYC are to be taken care of out.

mentioning that worries surrounding severe opposition within the payments bank area are exaggerated, she stated, adding the Noida-based employer is concentrated on to have 500 million clients through2020.

on the three payments financial institution candidates abandoning their licences, she said thoseentities dropped out because the payments banks space isn’t a core business for them, whereas for Paytm, it’s miles proper at the center.

it may be recalled that because April, the Cholamandalam group, Tech Mahindra and a consortium led bysun Pharma promoter Dilip Shanghvi (in non-public capability), IDFC financial institution and telecomcompany Telenor have surrendered their in-principle licences, blaming the stern RBI conditions that make such an entity commercially no longer viable.

meanwhile, Paytm today said it is going to be availing of the middle banking services from IT mainInfosys’ Finacle suite, to come to be the first PB to announce a tie-up with the Bengaluru-basedorganization.

Finacle’s regional head for boom markets, Venkatramana Gosavi stated small finance bank licensee Ujjivan has already selected the product, and it’s miles in talks with a number of the 18 small finance financial institution and bills financial institution licensees for greater tie-ups.

Disclosure: Paytm founder Vijay Shekhar Sharma’s One97 is an investor in gadgets 360.

download the devices 360 app for Android and iOS to live up to date with the cutting-edge tech news, product critiques, and exclusive offers on the popular mobiles.

Tags: Apps, digital Wallets, internet, online Wallets, payment bank, Paytm, RBI