Already in the midst of a massive growth spurt, Amazon is looking to fashion to keep fueling its expansion. For months there have been clues that the e-commerce giant was developing its own in-house clothing brands, and just last week, job postings from the company (paywall) hinted it was actively moving toward a launch. But it seems the launch already quietly occurred.

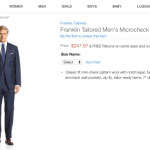

The company has introduced at least 1,800 different fashion products on its site, under seven different brand names it trademarked, according to a Feb. 21 note by Ed Yruma, managing director and equity research analyst at KeyBanc Capital Markets. As WWD reported (paywall), Amazon is selling a wide variety of items, including women’s clothing and bags, men’s tailored wear and accessories, and even children’s clothing. They exist under the labels Society New York, Lark & Ro, Scout + Ro, Franklin & Freeman, Franklin Tailored, James & Erin, and North Eleven.

Searches of public records confirm that Amazon owns the trademarks to these brands. A quick look at the items for sale, such as a turtleneck dress from Society New York for $39.97, and a cap-toe oxford by Franklin & Freeman for $53.97, indicates Amazon is sticking toward the cheaper end of the price spectrum for its in-house labels.

(Amazon has not confirmed that these are its private lines, but Quartz has reached out to the company for comment and will update this post with any response.)

In any case, Amazon has been moving toward launching its own lines as its fashion strategy shifts. Since it jumped into fashion retail more than a decade ago, it has occasionally struggled to gain traction, partnering with existing retailers and clothing brands. Its solution has at times been to acquire or launch its own outlets, including Shopbop and East Dane, and it makes sense that it would create its own clothing brands when its existing partnerships don’t offer what its shoppers want.

“When we see gaps, when certain brands have actually decided for their own reasons not to sell with us, our customer still wants a product like that,” Jeff Yurcisin, vice president of clothing at Amazon Fashion and CEO of Shopbop, said at a retail conference in October.

In-house brands can also sell extremely well. At fashion e-commerce powerhouse Revolve, the company’s private-label brands are some of its top sellers. And KeyBanc notes that, at their peak, Amazon’s margins in apparel are better than other goods, while the company has said fashion is one of its fastest-growing categories.

While Amazon faces definite headwinds to developing its apparel business—KeyBanc notes only about 15% of its active customers buy clothes through the site—the potential is there for Amazon to disrupt retail in the mass-market. Amazon has an immense amount of data to draw on, which could allow it to identify consumer trends and respond quickly, a capability that has allowed fast-fashion to take sales from chains such as Gap.

Successful private labels would also make it even more competitive against competitors that rely on brick-and-mortar stores. According to financial firm Cowen and Company, Amazon is on course to top Macy’s as the largest clothing retailer in the US this year.

The conditions are right for big profits, and more growth for Amazon.

[“source-Qz”]